You should be aware of the following things if offshore banking is something you are interested in in Nevis. There are strict laws in place to prevent the establishment of brass plate banks, and a license can only be granted to qualified foreign banks and eligible companies. A licensee must also be able to show proof of a Nevis location, as approved by Regulator of International Banking. This will usually be the bank's registered office.

Nevis offshore Banking

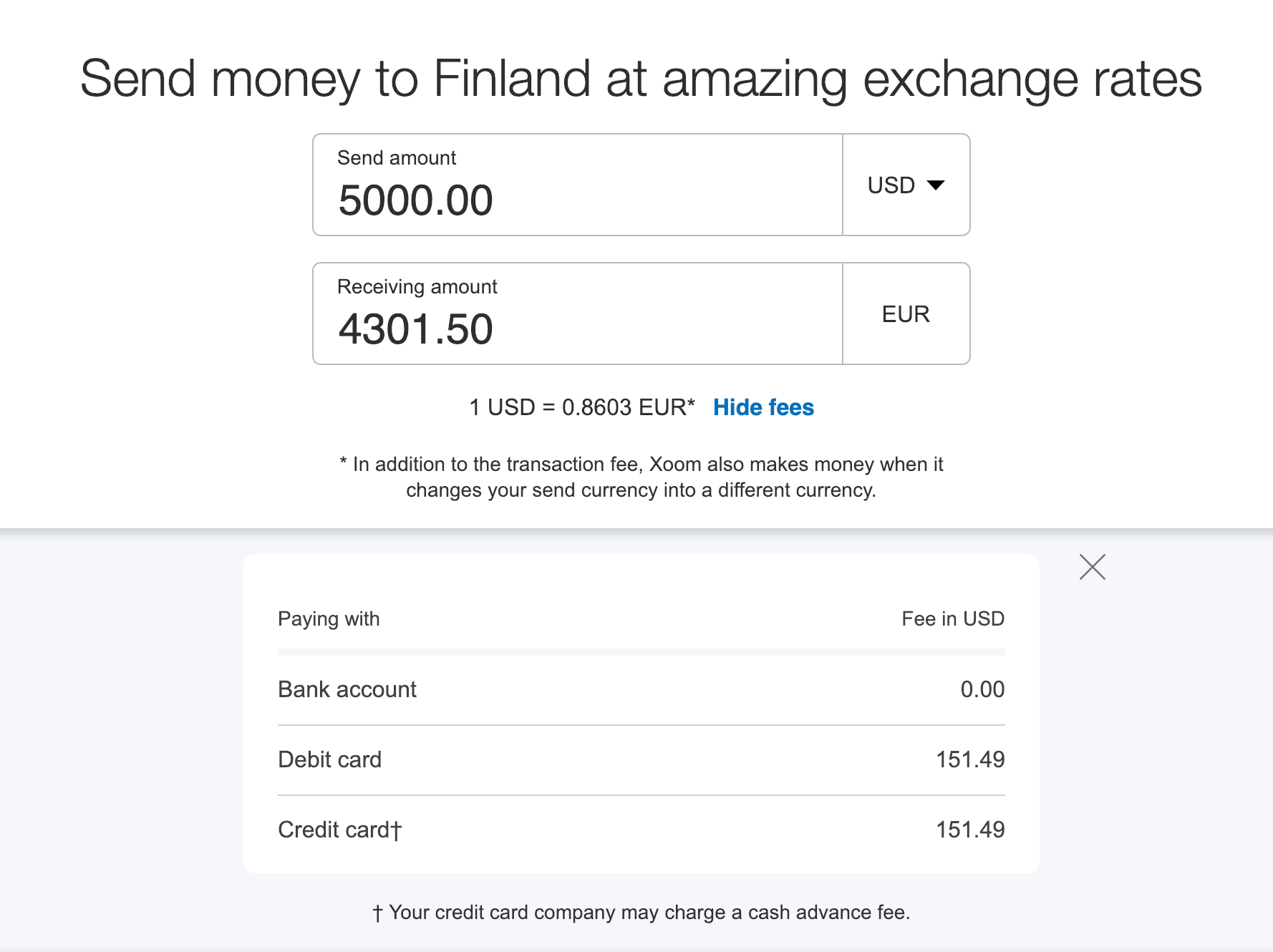

Nevis offshore banking is a convenient option for a diverse range of financial needs. The bank is a member the international financial group SWIFT and can transfer funds quickly in USD, EUR and nine other major currencies. The bank's strong balance sheet and zero loan exposure make it well-positioned to provide a variety of financial products for individuals and businesses around the world. Its motto is "efficient customer onboarding." Customers looking to open an account can benefit from the excellent customer service and 24 hour e-banking.

Nevis LLC

Nevis LLCs are a great way to protect your assets, while also allowing your creditors to negotiate lower debt settlements. LLCs are very welcome in Nevis. Since 1995, the government has continually improved the statutes regarding Nevis LLCs. For instance, the most recent amendment has reduced the amount of time that a charging order lien can be in place against the interest of a member in an LLC. The lien will fall off after three years and will not be renewable.

Nevis trust statute of limitations regarding fraudulent transfers

If you believe that the trustee is making a fraudulent transfer of your beneficiary's money, then you can file a lawsuit to recover the money from the trustee. To prove the trustee's guilt of fraud, you must show that the transfer took effect before the statute expired.

Nevis LLCs' investment policy

A Nevis LLC is a legal entity that is independent from a partnership or corporation. It has its own rights, liabilities, and is responsible in part for its own debts. It can be used for any legal purpose, such as manufacturing concerns, international finance arrangements, or real estate holdings.

Investment policy

Nevis' banking industry is thriving. It offers a wide variety of services including investment, asset management, wealth protection and asset protection. It has been operational for more than 30 years and has built a solid reputation for efficiency and speed. It was recently named the Caribbean's best offshore financial services location.

Allocation of assets

Nevis banking asset allocation allows an individual to choose the investment policy for his or her Nevis account. This can be achieved by setting investment goals and limiting risk. Monthly statements will be sent by the management company to the individual. Nevis management companies are also open to the appointment of an individual resident of the United States to serve as co-manager and make investment decisions.

FAQ

What kind of investment vehicle should I use?

There are two main options available when it comes to investing: stocks and bonds.

Stocks represent ownership interests in companies. They are better than bonds as they offer higher returns and pay more interest each month than annual.

You should focus on stocks if you want to quickly increase your wealth.

Bonds tend to have lower yields but they are safer investments.

Remember that there are many other types of investment.

These include real estate, precious metals and art, as well as collectibles and private businesses.

What should I consider when selecting a brokerage firm to represent my interests?

When choosing a brokerage, there are two things you should consider.

-

Fees - How much commission will you pay per trade?

-

Customer Service – Will you receive good customer service if there is a problem?

Look for a company with great customer service and low fees. Do this and you will not regret it.

What kinds of investments exist?

There are many types of investments today.

Here are some of the most popular:

-

Stocks - Shares in a company that trades on a stock exchange.

-

Bonds - A loan between 2 parties that is secured against future earnings.

-

Real Estate - Property not owned by the owner.

-

Options – Contracts allow the buyer to choose between buying shares at a fixed rate and purchasing them within a time frame.

-

Commodities-Resources such as oil and gold or silver.

-

Precious metals are gold, silver or platinum.

-

Foreign currencies - Currencies other that the U.S.dollar

-

Cash - Money that is deposited in banks.

-

Treasury bills – Short-term debt issued from the government.

-

Commercial paper - Debt issued to businesses.

-

Mortgages - Individual loans made by financial institutions.

-

Mutual Funds – Investment vehicles that pool money from investors to distribute it among different securities.

-

ETFs are exchange-traded mutual funds. However, ETFs don't charge sales commissions.

-

Index funds – An investment fund that tracks the performance a specific market segment or group of markets.

-

Leverage - The ability to borrow money to amplify returns.

-

Exchange Traded Funds, (ETFs), - A type of mutual fund trades on an exchange like any other security.

The best thing about these funds is they offer diversification benefits.

Diversification is when you invest in multiple types of assets instead of one type of asset.

This helps to protect you from losing an investment.

How can I make wise investments?

You should always have an investment plan. It is important to know what you are investing for and how much money you need to make back on your investments.

Also, consider the risks and time frame you have to reach your goals.

This way, you will be able to determine whether the investment is right for you.

Once you've decided on an investment strategy you need to stick with it.

It is better to only invest what you can afford.

When should you start investing?

The average person spends $2,000 per year on retirement savings. But, it's possible to save early enough to have enough money to enjoy a comfortable retirement. You might not have enough money when you retire if you don't begin saving now.

You should save as much as possible while working. Then, continue saving after your job is done.

You will reach your goals faster if you get started earlier.

Consider putting aside 10% from every bonus or paycheck when you start saving. You may also invest in employer-based plans like 401(k)s.

Make sure to contribute at least enough to cover your current expenses. After that, you can increase your contribution amount.

What investments should a beginner invest in?

Investors new to investing should begin by investing in themselves. They need to learn how money can be managed. Learn how to save for retirement. How to budget. Learn how to research stocks. Learn how to read financial statements. Learn how to avoid scams. Make wise decisions. Learn how to diversify. Learn how to protect against inflation. Learn how to live within ones means. Learn how to invest wisely. Learn how to have fun while you do all of this. It will amaze you at the things you can do when you have control over your finances.

What are the best investments to help my money grow?

You must have a plan for what you will do with the money. If you don't know what you want to do, then how can you expect to make any money?

Additionally, it is crucial to ensure that you generate income from multiple sources. If one source is not working, you can find another.

Money does not come to you by accident. It takes planning and hardwork. So plan ahead and put the time in now to reap the rewards later.

Statistics

- According to the Federal Reserve of St. Louis, only about half of millennials (those born from 1981-1996) are invested in the stock market. (schwab.com)

- An important note to remember is that a bond may only net you a 3% return on your money over multiple years. (ruleoneinvesting.com)

- If your stock drops 10% below its purchase price, you have the opportunity to sell that stock to someone else and still retain 90% of your risk capital. (investopedia.com)

- Some traders typically risk 2-5% of their capital based on any particular trade. (investopedia.com)

External Links

How To

How to Invest in Bonds

Bond investing is one of most popular ways to make money and build wealth. However, there are many factors that you should consider before buying bonds.

You should generally invest in bonds to ensure financial security for your retirement. Bonds can offer higher rates to return than stocks. Bonds are a better option than savings or CDs for earning interest at a fixed rate.

You might consider purchasing bonds with longer maturities (the time between bond maturity) if you have enough cash. While longer maturity periods result in lower monthly payments, they can also help investors earn more interest.

There are three types to bond: corporate bonds, Treasury bills and municipal bonds. Treasuries bills are short-term instruments issued by the U.S. government. They pay low interest rates and mature quickly, typically in less than a year. Corporate bonds are typically issued by large companies such as General Motors or Exxon Mobil Corporation. These securities are more likely to yield higher yields than Treasury bills. Municipal bonds are issued from states, cities, counties and school districts. They typically have slightly higher yields compared to corporate bonds.

Choose bonds with credit ratings to indicate their likelihood of default. Higher-rated bonds are safer than low-rated ones. You can avoid losing your money during market fluctuations by diversifying your portfolio to multiple asset classes. This helps prevent any investment from falling into disfavour.